- Date:

- Author:

- Stefan Gerlach

The recent burst of inflation in the US and in many other countries has led investors to wonder whether the entire inflation environment has changed.

US CPI inflation declined in April, but by very little. Headline inflation over 12-months declined from 5.0% in March to 4.9% in April, which is the lowest inflation rate since April 2021. Month-on-month headline inflation was 0.4%, far above the 0.17% implied by the Federal Reserve’s 2% inflation objective.

Core inflation, which also was 0.4% month-on-month, fell from 5.6% in March to 5.5% in April. However, core inflation has been fluctuating around this level since January of this year and has thus appeared resilient to the Fed’s interest rate increases.

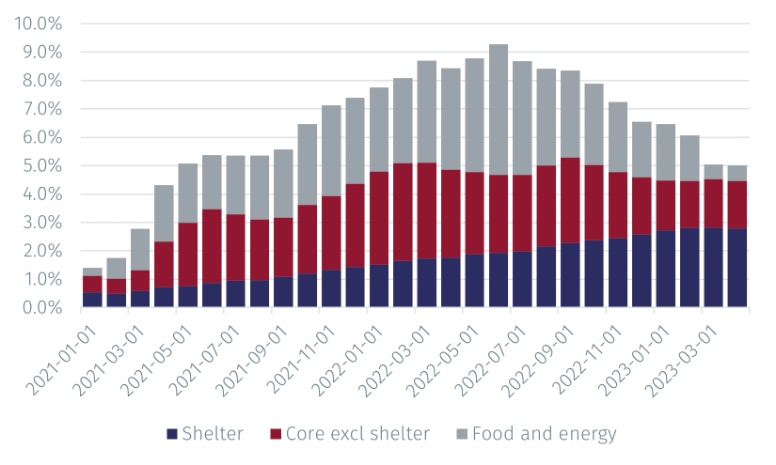

To see better the evolution of inflation, the figure below shows headline inflation and its components: headline inflation is the sum of the rate of change of food and energy prices and core inflation, which in turn can be divided into shelter and core inflation excluding shelter.

Source: www.bls.gov. Data as at 12 May 2023.

The graph shows that in spring of 2021 inflation started to rise. To a great extent this was due to base effects, that is, the price falls that occurred in 2020 as the Covid pandemic spread dropped out of the calculation of 12-month inflation. While this was expected, the rise in inflation in the autumn of 2021 took commentators by surprise.

That increase was due to a combination of rising prices for food and energy and for the non-shelter component of core inflation. However, the shelter component also started rising but so gradually that few commentators took notice.

Headline inflation peaked in June 2022. Subsequently, its marked decline was largely due to a moderation of food and energy prices. Over time, however, core inflation excluding shelter also started to decline.

The figure also shows the main problem the Fed has been facing: the gradual increase in the rate of increase of the cost of shelter. From August 2022 onwards, it alone was responsible for pushing inflation above the Fed’s 2% target.

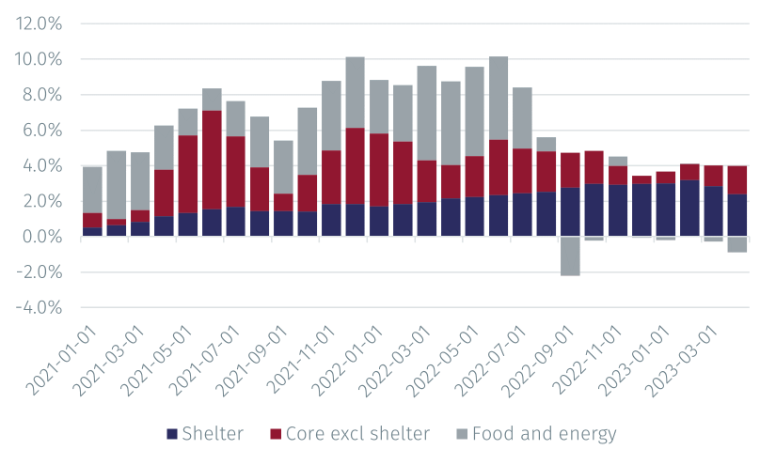

To see more clearly the behaviour of these inflation components, it is useful to look at annualised inflation over three months, as is done in the figure below. It shows that core inflation excluding shelter rose sharply in the spring of 2021 and in early 2022 and that it has contributed about 1 percentage point to the overall inflation rate in recent months. It also shows that the rate of increase in food and energy prices has fluctuated around zero since August 2022 and that it was negative in March and April this year.

Source: www.bls.gov. Data as at 12 May 2023.

The figure illustrates that the most important component of inflation is the rate of increase in the cost of shelter. It peaked at 3.2% in February but fell in both March and April and now stands at 2.4%. There is thus some evidence that the important and sluggish increase in the cost of shelter has started to turn.

What will the Fed think about these data? Without doubt it will focus squarely on the data for May, which will be released on 12 June, that is, two days before the FOMC meeting on 14 June. But given that so much of core inflation is due to the increasing cost of shelter, which changes only gradually over time, it seems unlikely that core inflation over 12 months will change much between April and May.

The Fed is therefore likely to focus more on other indicators, such as initial jobless claims, which have been rising in recent weeks, and measures of wage pressures, such the Atlanta Fed’s wage growth tracker, which has stopped rising in recent months and even declined a little. It will therefore be critical to monitor how these variables evolve before the next Federal Open Market Committee meeting.

Important Information

The value of investments and the income derived from them can fall as well as rise, and past performance is no indicator of future performance. Investment products may be subject to investment risks involving, but not limited to, possible loss of all or part of the principal invested.

This document does not constitute and shall not be construed as a prospectus, advertisement, public offering or placement of, nor a recommendation to buy, sell, hold or solicit, any investment, security, other financial instrument or other product or service. It is not intended to be a final representation of the terms and conditions of any investment, security, other financial instrument or other product or service. This document is for general information only and is not intended as investment advice or any other specific recommendation as to any particular course of action or inaction. The information in this document does not take into account the specific investment objectives, financial situation or particular needs of the recipient. You should seek your own professional advice suitable to your particular circumstances prior to making any investment or if you are in doubt as to the information in this document.

Although information in this document has been obtained from sources believed to be reliable, no member of the EFG group represents or warrants its accuracy, and such information may be incomplete or condensed. Any opinions in this document are subject to change without notice. This document may contain personal opinions which do not necessarily reflect the position of any member of the EFG group. To the fullest extent permissible by law, no member of the EFG group shall be responsible for the consequences of any errors or omissions herein, or reliance upon any opinion or statement contained herein, and each member of the EFG group expressly disclaims any liability, including (without limitation) liability for incidental or consequential damages, arising from the same or resulting from any action or inaction on the part of the recipient in reliance on this document.

The availability of this document in any jurisdiction or country may be contrary to local law or regulation and persons who come into possession of this document should inform themselves of and observe any restrictions. This document may not be reproduced, disclosed or distributed (in whole or in part) to any other person without prior written permission from an authorised member of the EFG group.

This document has been produced by EFG Asset Management (UK) Limited for use by the EFG group and the worldwide subsidiaries and affiliates within the EFG group. EFG Asset Management (UK) Limited is authorised and regulated by the UK Financial Conduct Authority, registered no. 7389746. Registered address: EFG Asset Management (UK) Limited, Park House, 116 Park Street, London W1K 6AP, United Kingdom, telephone +44 (0)20 7491 9111.