- Date:

The recent burst of inflation in the US and in many other countries has led investors to wonder whether the entire inflation environment has changed.

The Bank of England recently updated its growth projections in its May monetary policy report, forecasting a contraction in GDP in 2023. In this Macro Flash Note, Sam Jochim looks at the uncertainty surrounding these projections and the main headwinds facing the UK economy.

UK GDP expanded 0.8% quarter-on-quarter in Q1 according to data published by the Office for National Statistics (ONS).1 This represents relatively strong growth and could be associated with a healthy economy if taken at face value. However, when looking at the monthly estimates of GDP provided by the ONS, there is evidence of a slowdown in activity over the quarter with GDP falling by 0.1% month-on-month in March.

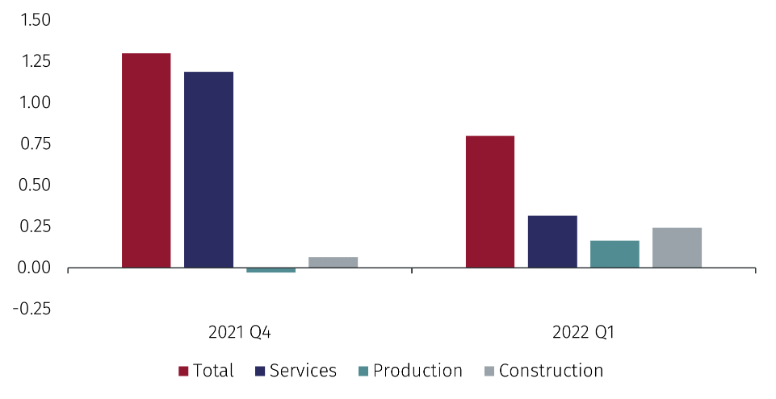

In output terms, first quarter growth was driven by an increase in services, which was also the case for the final quarter of 2021 (see Figure 1). These increases matched higher demand for spending on restaurants and hotels, as measured by the expenditure approach to calculating GDP.

Source: ONS and EFGAM calculations.

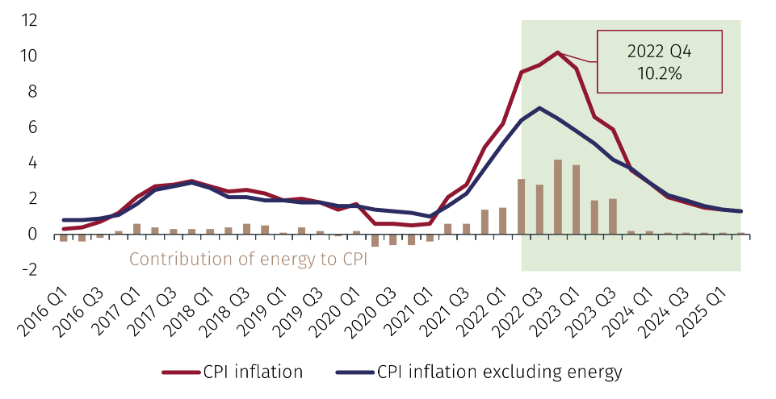

Since services play an important role in the UK economy, it is notable that the Bank of England (BoE) forecasts a slowdown in demand due to the squeeze in real disposable incomes resulting from high inflation.2 The BoE projects CPI inflation to peak at 10.2% year-on-year in Q4 2022 (see Figure 2). This would be later than in the US where the peak may have already occurred. The reason for this is the expected increase in household energy prices in October due to Ofgem price cap increases.3 4 The BoE expects this to be compounded by higher tradeable goods prices, a corollary from lockdowns in China.

Source: BoE and EFGAM calculations.

As real incomes decline, the aggregate savings accumulated by households during the pandemic should support their ability to smooth consumption according to the BoE. Whether this materialises remains to be seen and represents a downside risk to the BoE forecast.

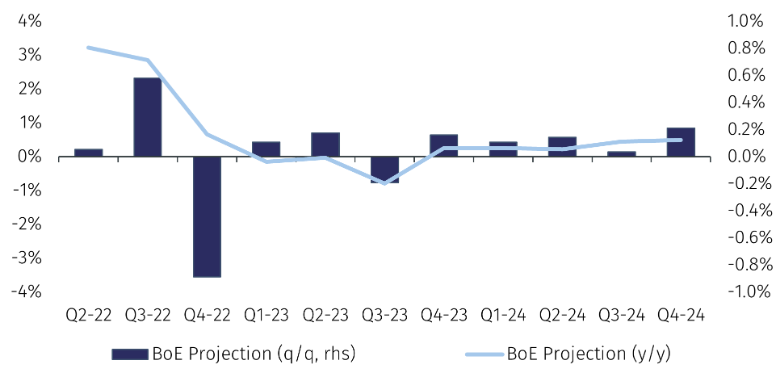

In response to rising inflation, the BoE has raised Bank Rate four times since December 2021. The May monetary policy report signalled that further rate hikes will be needed in the coming months. The impact of these rate increases remains to be seen. While they will slow the economy, the expected decline in inflation in the following years would increase real disposable incomes if wage growth were unaffected. This could provide a boost to growth. As such, there is much uncertainty in the BoE projections for UK growth (see Figure 3) over the coming years.

Source: BoE and EFGAM calculations.

The BoE is currently projecting a sharp slowdown in growth. The BoE anticipates that GDP will decline by 0.25% in 2023, followed by 0.25% growth in 2024. It is important to note these projections are unusually uncertain. A wide range of factors will influence the economic outcome, including the degree of monetary tightening that will be adopted to rein in inflation. The BoE projections are based on the path of Bank Rate implied in forward markets which, as at the time of the BoE’s forecasting exercise believed it will rise to 2.5% at the end of 2023. If Bank Rate were to rise more than this, the growth projection would be further downgraded.

Furthermore, it is extremely difficult to predict how the zero-Covid policy adopted in China will impact the global economy, but the longer it stays in place the higher the risks are to growth. The same is true of the war in Ukraine due to the high degree of uncertainty regarding its duration and outcome, and of the resulting commodity price volatility adding to the headwinds to global growth.

From Q1 2023 onwards, the BoE projects year-on-year growth to moderate to between -0.8% and 0.5%. Given the high levels of uncertainty surrounding the outlook, the risks are large and appear to be skewed to the downside. While the BoE makes no mention of a recession in its May monetary policy report, the UK economy faces significant risks over the next 12-18 months and the BoE itself projects that UK GDP will be moderately lower in 2023 than this year.

1 https://www.ons.gov.uk/economy/grossdomesticproductgdp/bulletins/gdpfirstquarterlyestimateuk/latest

2 https://www.bankofengland.co.uk/-/media/boe/files/monetary-policy-report/2022/may/monetary-policy-report-may-2022.pdf

3 3 Ofgem regulates energy for the UK and limits the rate that energy suppliers can charge using a price cap which is updated every April and October

4 https://www.ofgem.gov.uk/publications/price-cap-increase-ps693-april#:~:text=Related%20links&text=The%20energy%20price%20cap%20will,%C2%A31%2C309%20to%20%C2%A32%2C017

Important Information

The value of investments and the income derived from them can fall as well as rise, and past performance is no indicator of future performance. Investment products may be subject to investment risks involving, but not limited to, possible loss of all or part of the principal invested.

This document does not constitute and shall not be construed as a prospectus, advertisement, public offering or placement of, nor a recommendation to buy, sell, hold or solicit, any investment, security, other financial instrument or other product or service. It is not intended to be a final representation of the terms and conditions of any investment, security, other financial instrument or other product or service. This document is for general information only and is not intended as investment advice or any other specific recommendation as to any particular course of action or inaction. The information in this document does not take into account the specific investment objectives, financial situation or particular needs of the recipient. You should seek your own professional advice suitable to your particular circumstances prior to making any investment or if you are in doubt as to the information in this document.

Although information in this document has been obtained from sources believed to be reliable, no member of the EFG group represents or warrants its accuracy, and such information may be incomplete or condensed. Any opinions in this document are subject to change without notice. This document may contain personal opinions which do not necessarily reflect the position of any member of the EFG group. To the fullest extent permissible by law, no member of the EFG group shall be responsible for the consequences of any errors or omissions herein, or reliance upon any opinion or statement contained herein, and each member of the EFG group expressly disclaims any liability, including (without limitation) liability for incidental or consequential damages, arising from the same or resulting from any action or inaction on the part of the recipient in reliance on this document.

The availability of this document in any jurisdiction or country may be contrary to local law or regulation and persons who come into possession of this document should inform themselves of and observe any restrictions. This document may not be reproduced, disclosed or distributed (in whole or in part) to any other person without prior written permission from an authorised member of the EFG group.

This document has been produced by EFG Asset Management (UK) Limited for use by the EFG group and the worldwide subsidiaries and affiliates within the EFG group. EFG Asset Management (UK) Limited is authorised and regulated by the UK Financial Conduct Authority, registered no. 7389746. Registered address: EFG Asset Management (UK) Limited, Leconfield House, Curzon Street, London W1J 5JB, United Kingdom, telephone +44 (0)20 7491 9111.