- Date:

- Author:

- Sam Jochim

The recent burst of inflation in the US and in many other countries has led investors to wonder whether the entire inflation environment has changed.

The Bank of Japan (BoJ) made no changes to interest rates at its meeting in April but announced a broad review of the impact of its monetary policy over the last 25 years. In this Macro Flash Note, Economist Sam Jochim assesses the implications for future monetary policy decisions.

In a statement before his first meeting as BoJ Governor, Kazuo Ueda pointed to a possible normalisation of the BoJ’s yield curve control (YCC) policy if the central bank’s inflation forecasts were close to its 2% target and had a high probability of materialising.1

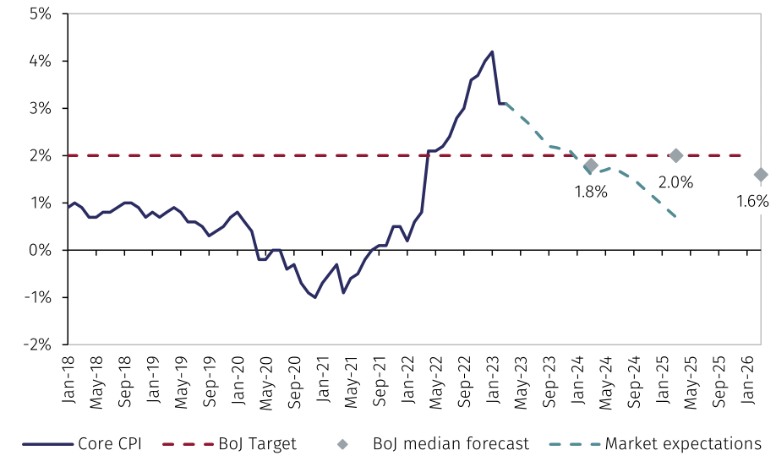

The BoJ policy board members’ median forecasts for core inflation, which excludes fresh food prices, are 1.8%, 2.0% and 1.6% in fiscal years 2023, 2024 and 2025 respectively (see Chart 1). While the BoJ sees risks to the inflation outlook as being skewed to the upside in 2023, it predicts that there is a greater risk price increases will fall below its forecasts in 2024 and 2025. Market expectations align with this view, averaging above the BoJ point forecast for fiscal year 2023 and falling below it thereafter.

Source: BoJ, Refinitiv, FactSet and EFGAM calculations. Data as at 02 May 2023.

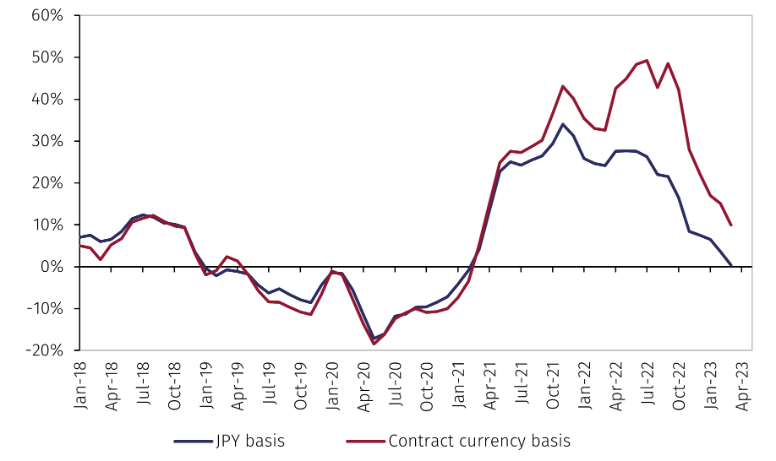

The BoJ attributes the recent slowdown in year-on-year core inflation to the Japanese government’s measures to push down energy prices. Without such measures, underlying price pressures are still seen to be accelerating in Japan.2 This has largely been a result of a pass-through to consumer prices of cost increases led by a rise in import prices and exacerbated by a depreciation of the yen (see Chart 2).

Source: Refinitiv and EFGAM calculations. Data as at 02 May 2023.

That the medium-term outlook for prices is below the BoJ’s 2% target and risks are skewed to the downside reflects the combination of an expected fading of the impact of previous import price increases, as well as an increase in the negative contribution of energy prices.

Given the limited direct impact of monetary policy on supply side factors, the lack of policy change at the BoJ meeting in April was unsurprising. Governor Ueda had implied this would be the likely outcome, noting that “you don’t want to tighten monetary policy knowing that cost-push inflation will cool the economy”.3 One of the main takeaways from the meeting was that it will require strong, demand-driven inflation for the BoJ to begin normalising its monetary policy stance.

Though it is likely to be a lengthy process, the conditions for policy normalisation under Governor Ueda are being established. In its monetary policy statement, the BoJ dropped its usual guidance on future interest rates remaining at current levels or being lowered if deemed appropriate. Most importantly, it also announced it would begin a 12-18 month broad-perspective review of its monetary policy over the last 25 years.4

The review will particularly focus on the past interactions between monetary policy and economic activity and prices. In its outlook for economic activity and prices, the BoJ alluded to the potential for upward inflation surprises stemming from stronger than expected wage growth.

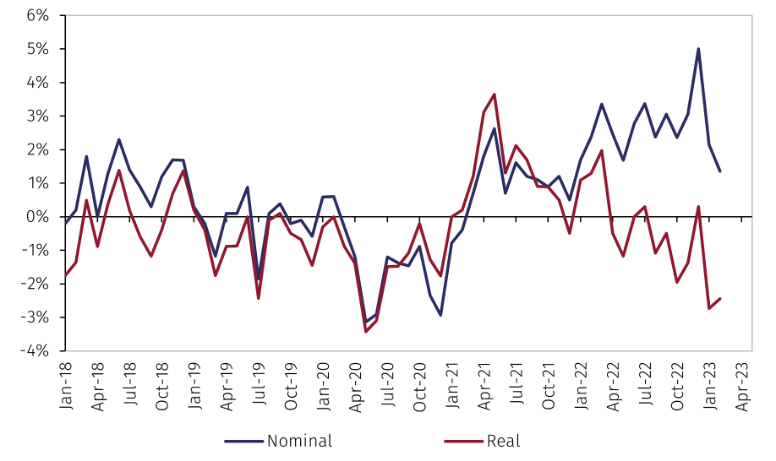

It is already expected that wage growth in March will be stronger than in previous years in Japan. While data is only available until February, it shows that recent year-on-year nominal wage growth has been positive and real wage growth has been negative (see Chart 3). If wage growth in March and April is stronger than expected and real wage growth turns positive, household consumption could strengthen and lead to demand-driven inflation.

Source: Refinitiv and EFGAM calculations. Data as at 03 May 2023.

To conclude, while there were no changes to monetary policy at the BoJ meeting in April, the conditions for a normalisation are being established with a review of the last 25 years of monetary policy. Upside surprises to wage growth data in the coming months could lay the foundations for demand-driven inflation and the BoJ to raise interest rates and exit its YCC policy. However, there is a great deal of uncertainty surrounding this scenario and Governor Ueda has pointed to the BoJ remaining patient with monetary easing. In any case, the possibility of future policy normalisation is likely to be well signalled.

1 The BoJ targets a yield of 0% on Japanese government bonds with a 10-year maturity and allows the yield to fluctuate 0.5 percentage points either side of this.

2 https://www.boj.or.jp/en/mopo/outlook/gor2304b.pdf

3 https://www.reuters.com/markets/asia/bojs-ueda-how-deal-with-cost-push-inflation-dependent-economic-conditions-2023-04-26/

4 https://www.boj.or.jp/en/mopo/mpmdeci/mpr_2023/k230428a.pdf

Important Information

The value of investments and the income derived from them can fall as well as rise, and past performance is no indicator of future performance. Investment products may be subject to investment risks involving, but not limited to, possible loss of all or part of the principal invested.

This document does not constitute and shall not be construed as a prospectus, advertisement, public offering or placement of, nor a recommendation to buy, sell, hold or solicit, any investment, security, other financial instrument or other product or service. It is not intended to be a final representation of the terms and conditions of any investment, security, other financial instrument or other product or service. This document is for general information only and is not intended as investment advice or any other specific recommendation as to any particular course of action or inaction. The information in this document does not take into account the specific investment objectives, financial situation or particular needs of the recipient. You should seek your own professional advice suitable to your particular circumstances prior to making any investment or if you are in doubt as to the information in this document.

Although information in this document has been obtained from sources believed to be reliable, no member of the EFG group represents or warrants its accuracy, and such information may be incomplete or condensed. Any opinions in this document are subject to change without notice. This document may contain personal opinions which do not necessarily reflect the position of any member of the EFG group. To the fullest extent permissible by law, no member of the EFG group shall be responsible for the consequences of any errors or omissions herein, or reliance upon any opinion or statement contained herein, and each member of the EFG group expressly disclaims any liability, including (without limitation) liability for incidental or consequential damages, arising from the same or resulting from any action or inaction on the part of the recipient in reliance on this document.

The availability of this document in any jurisdiction or country may be contrary to local law or regulation and persons who come into possession of this document should inform themselves of and observe any restrictions. This document may not be reproduced, disclosed or distributed (in whole or in part) to any other person without prior written permission from an authorised member of the EFG group.

This document has been produced by EFG Asset Management (UK) Limited for use by the EFG group and the worldwide subsidiaries and affiliates within the EFG group. EFG Asset Management (UK) Limited is authorised and regulated by the UK Financial Conduct Authority, registered no. 7389746. Registered address: EFG Asset Management (UK) Limited, Park House, 116 Park Street, London W1K 6AP, United Kingdom, telephone +44 (0)20 7491 9111.