- Date:

- Author:

- Sam Jochim

The recent burst of inflation in the US and in many other countries has led investors to wonder whether the entire inflation environment has changed.

The International Monetary Fund (IMF) recently released its latest World Economic Outlook (WEO).1 Although the outlook for global growth remains broadly unchanged since its January 2023 update, the balance of risks has shifted to the downside. In this Macro Flash Note, Economist Sam Jochim summarises the outlook.

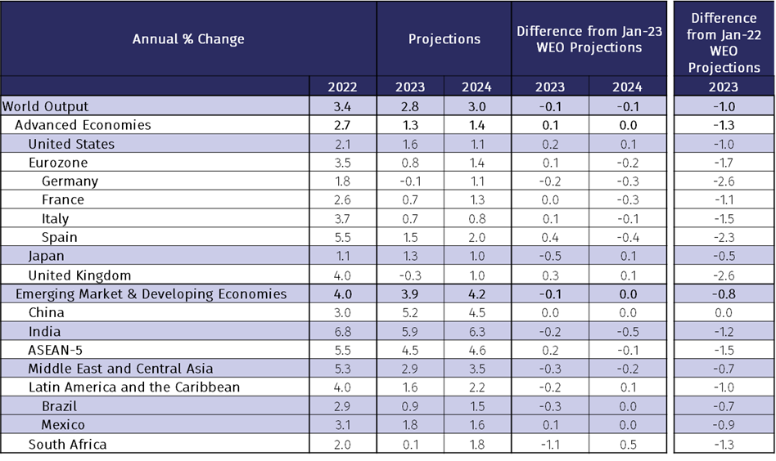

IMF growth forecasts

For 2023, the IMF forecasts global GDP growth of 2.8%, broadly in line with its previous forecasts from January 2023 (see Table 1).2 Notably, this is well below the 3.8% projected in January 2022 before Russia invaded Ukraine, since then many central banks have raised interest rates rapidly.

Source: IMF and EFGAM calculations. Data as at April 2023.

The IMF’s baseline scenario for growth is also weak compared to pre-pandemic standards. Both 2023 and 2024 are expected to see global growth fall below the 2010-19 average of 3.7% a year.

However, there are regional discrepancies within these forecasts. Emerging market economies in Asia, including the ASEAN-5 group, are expected to benefit from China’s economic reopening and grow at a faster rate than other emerging market regions.3

Within developed economies, the IMF expects the US to grow at twice the rate of the eurozone this year. Both economies’ growth forecasts have been upgraded relative to January’s WEO update but large differences are expected within the eurozone. While Spain’s economy is expected to grow by 1.5% this year, Germany’s economy is expected to contract by 0.1%.

The baseline scenario assumes no further shocks to the financial sector and that recent events involving Silicon Valley Bank and Credit Suisse are contained, with no material disruptions to global economic activity. An alternative scenario is also presented whereby further shocks stemming from financial sector fragility cause a moderate additional tightening in credit conditions and global growth is 0.3 percentage points below the baseline. Under this scenario, the IMF expects the US, eurozone and Japanese economies to fall further below their 2023 baseline projections, by around 0.4 percentage points.

Risks to the outlook

While the alternative scenario assumes a moderate additional tightening, a more severe tightening in global financial conditions could see bank lending in the US and other advanced economies decline sharply. In turn, household and business confidence could decline leading to higher desired saving and lower investment. Lower import demand in large, developed economies would spill over to global GDP growth. In this scenario the IMF predicts that global GDP could be up to 1.8 percentage points below the baseline scenario.

Rising real interest rates in conjunction with elevated corporate and household debt is another source of risk highlighted by the IMF. In this case, debt servicing costs would be expected to rise while income growth would be weaker than the baseline. The result would be reduced investment and consumption, higher unemployment, and higher default rates. The WEO points to even lower global growth if this risk materialises.

While inflation has been declining in most economies, core inflation has proved stickier, and the IMF sees this as another risk to the outlook. Central banks could be forced to maintain a restrictive policy for longer than expected, negatively affecting economic growth and financial stability.

An escalation of the war in Ukraine is another risk outlined in the WEO. 2022-23 saw an energy crisis avoided in Europe, with sufficient gas storage and a mild winter helping overcome the challenges of sanctions on Russia. However, the IMF believes an escalation of the war could trigger a renewed energy crisis, leading to higher inflation and lower growth.

The final downside risk highlighted is fragmentation hampering multilateral cooperation. Notable developments such as Brexit and China-US trade tensions have encouraged the decline in cross-border economic integration. Further geoeconomic fragmentation risks causing a decline in international flows of labour, goods, and capital. The IMF notes that some countries may benefit from a rearrangement in global trade flows but the overall impact on global economic wellbeing will likely be negative.

Additionally, one of the more significant factors providing a boost to global growth in 2023 is the economic reopening of China. However, the IMF notes that if this were to stall there would be significant cross-border effects given China’s role in global trade.

On the upside, the IMF stressed that the global economy could prove more resilient than expected. With a high stock of savings and tight labour markets in many economies, household consumption could exceed forecasts and boost activity.

Medium-term outlook

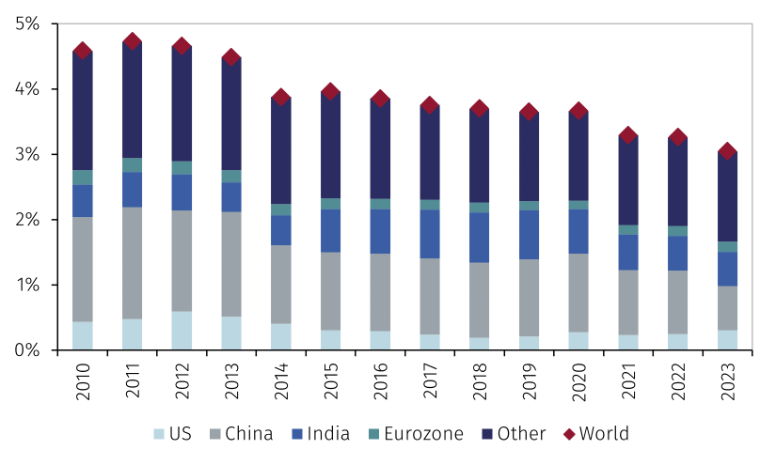

Finally, the IMF projects global GDP growth at 3% in 5-years. This is the lowest medium-term growth forecast published in all WEO reports since 1990. In the IMF’s view, this decline reflects slower labour force growth, geoeconomic fragmentation, and lower growth expectations for China and other large EM economies (see Chart 1).

Source: IMF. Data as at April 2023.

Summary and EFGAM view

In summary, the latest IMF WEO portrays a similar picture to the January 2023 update, but a significantly worse picture compared to the January 2022 update. Global growth is expected to slow, driven by a slowdown in advanced economies. Risks remain skewed to the downside, and the medium-term outlook is the lowest of any previous IMF WEO report.

Economic data continues to suggest a deceleration of activity in developed economies for this year. In our view, the monetary policy tightening in the US, eurozone, and UK is not over yet, although it is coming closer to an end. In the US, interest rates are likely to be raised once more, but the cumulative effect of the large monetary tightening is yet to be felt. It is likely the US economy will enter a mild recession later in 2023. Overall, although the US might end the year with positive annual growth, the headline number may hide some volatility over the coming quarters. This may also be true for the eurozone, while a recession in the UK is already the baseline.

The global economy could avoid a recession in 2023 if the supporting factors of China’s economic reopening materialise, and the rundown of high savings and tight labour markets in many economies provide an extra boost to consumer expenditure. Nonetheless, with the global economy facing a significant slowdown in activity, economies will remain vulnerable to shocks, and a global recession cannot be ruled out.

1 https://www.imf.org/en/Publications/WEO/Issues/2023/04/11/world-economic-outlook-april-2023

2 IMF forecasts were made after the collapse of Silicon Valley Bank and the sale of Credit Suisse to UBS

3 ASEAN-5 refers to Indonesia, Malaysia, the Philippines, Singapore and Thailand

Important Information

The value of investments and the income derived from them can fall as well as rise, and past performance is no indicator of future performance. Investment products may be subject to investment risks involving, but not limited to, possible loss of all or part of the principal invested.

This document does not constitute and shall not be construed as a prospectus, advertisement, public offering or placement of, nor a recommendation to buy, sell, hold or solicit, any investment, security, other financial instrument or other product or service. It is not intended to be a final representation of the terms and conditions of any investment, security, other financial instrument or other product or service. This document is for general information only and is not intended as investment advice or any other specific recommendation as to any particular course of action or inaction. The information in this document does not take into account the specific investment objectives, financial situation or particular needs of the recipient. You should seek your own professional advice suitable to your particular circumstances prior to making any investment or if you are in doubt as to the information in this document.

Although information in this document has been obtained from sources believed to be reliable, no member of the EFG group represents or warrants its accuracy, and such information may be incomplete or condensed. Any opinions in this document are subject to change without notice. This document may contain personal opinions which do not necessarily reflect the position of any member of the EFG group. To the fullest extent permissible by law, no member of the EFG group shall be responsible for the consequences of any errors or omissions herein, or reliance upon any opinion or statement contained herein, and each member of the EFG group expressly disclaims any liability, including (without limitation) liability for incidental or consequential damages, arising from the same or resulting from any action or inaction on the part of the recipient in reliance on this document.

The availability of this document in any jurisdiction or country may be contrary to local law or regulation and persons who come into possession of this document should inform themselves of and observe any restrictions. This document may not be reproduced, disclosed or distributed (in whole or in part) to any other person without prior written permission from an authorised member of the EFG group.

This document has been produced by EFG Asset Management (UK) Limited for use by the EFG group and the worldwide subsidiaries and affiliates within the EFG group. EFG Asset Management (UK) Limited is authorised and regulated by the UK Financial Conduct Authority, registered no. 7389746. Registered address: EFG Asset Management (UK) Limited, Park House, 116 Park Street, London W1K 6AP, United Kingdom, telephone +44 (0)20 7491 9111.