- Date:

- Author:

- Sam Jochim

The recent burst of inflation in the US and in many other countries has led investors to wonder whether the entire inflation environment has changed.

The International Monetary Fund (IMF) recently released its latest World Economic Outlook (WEO).1 The outlook for growth has worsened relative to the IMF WEO July update. In this Macro Flash Note, Sam Jochim summarises the changes.

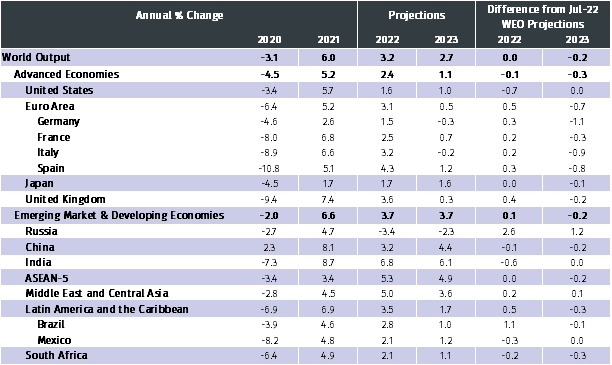

For 2022, the IMF is forecasting global economic growth of 3.2% (see Table 1), unchanged from its previous forecast from July. While this may seem positive given the current economic environment, the headline number hides large discrepancies across different regions. For example, the US saw a large downgrade to growth in 2022, with the IMF pointing to an unexpected contraction in Q2 as the main driver behind the change. The opposite is true for the eurozone, which saw a 0.5 percentage point increase to its growth projection for 2022. This reflects a stronger than expected Q2 as Southern European countries such as Italy and Spain witnessed a recovery in tourism-related services. It is of note that most of the changes to 2022 growth projections reflect data that was released in Q2. The IMF highlighted that for the remainder of 2022 and throughout 2023, the outlook is one of a broad-based slowdown.

Source: IMF, World Economic Outlook, October 2022.

For 2023, the IMF has downgraded its projection for global GDP by -0.2 percentage points to 2.7%. If this were to materialise, it would represent the slowest growth, outside of the Global Financial Crisis and pandemic crisis, since the 2.5% seen in 2001. According to the IMF, this is the result of the materialisation of several downside risks highlighted in the April 2022 WEO.2, 3 In particular, the IMF sees tighter financial conditions associated with expectations of higher interest rates, tighter gas supplies to Europe due to the war in Ukraine, and the slowdown in China due to its zero-Covid policy and worsening real estate crisis as the three key factors shaping the outlook. As with the previous WEO, the IMF noted that there remains an unusually elevated number of downside risks to global economies. While these risks have evolved since April, the challenges facing policymakers stem from the same causes.

The combination of slowing growth and high inflation creates a difficult situation for central banks. Raising interest rates too far to fight inflation risks tipping economies into prolonged recessions. At the same time, not tightening enough may cause inflation to become more entrenched, requiring a more prolonged period of tighter policy in the future. As such, the IMF highlighted under or overtightening of monetary policy as one of the main downside risks to its growth projections in the latest WEO.

The IMF also emphasised that differences in economic policies have the potential to continue to contribute to US dollar strength. The path of economic policy in the US and UK, China, and Japan have not been aligned. The UK has been tightening monetary policy at a slower pace than the US. In China, monetary policy has been eased due to slowing growth and low inflation. Japan’s policy rates will likely remain low, according to the IMF, given low underlying core inflation and weak wage growth. It is notable that Japanese authorities intervened to support the yen in September following rapid depreciation against the US dollar amid a widening interest rate differential. Further US dollar strength could increase cross-border tensions regarding competitiveness, as well as adding upward pressure to inflation outside the US given the predominance of dollar pricing in international trade. This is seen by the IMF as another key downside risk to growth.

Inflationary forces could also persist for longer through further shocks to energy prices, which remain particularly sensitive to the war in Ukraine. Extreme weather events could impact the global supply of food, placing upward pressure on prices. The IMF stressed that both cases could result in reduced disposable income, acting as a drag on growth.

Widespread debt distress in vulnerable emerging markets was also cited by the IMF as a threat to global growth. An increase in capital outflows could cause distress in emerging markets with large external financing needs. On top of this, further US dollar strength could trigger balance sheet vulnerabilities in emerging markets with high levels of US dollar-denominated debt. According to the IMF, a widening debt crisis in these economies could provoke a global recession.

China’s zero-Covid policy has had a significant impact on domestic growth, as well as the global growth outlook due to the expected slowdown in trade. Downside risks to China’s recovery, compounded by signs of a significant slowdown in the real estate sector, continue to dominate the WEO. The real estate sector accounts for around 20% of GDP in China, meaning a further escalation of the current negative feedback loop between the real estate sector and the Chinese economy could have a large impact on China’s medium-term growth.

Following the invasion of Ukraine, relations between Russia and many other countries have become increasingly fractured. Geopolitical tensions between other countries, such as the US and China, have also spiked this year. This risks disrupting trade and impacting capital flows. The IMF highlighted this as another downside risk to global growth.

In summary, the latest IMF economic projections portray a more negative outlook for global growth, with slowdowns expected in most economies over the next year. The IMF draws attention to the materialisation of multiple risks highlighted in the April WEO, as well as several new downside risks which have emerged over the year.

1 https://www.imf.org/en/Publications/WEO/Issues/2022/10/11/world-economic-outlook-october-2022

2 https://www.imf.org/en/Publications/WEO/Issues/2022/04/19/world-economic-outlook-april-2022

3 See EFGAM Macro Flash Note, IMF: war sets back the global recovery (April 2022)

Important Information

The value of investments and the income derived from them can fall as well as rise, and past performance is no indicator of future performance. Investment products may be subject to investment risks involving, but not limited to, possible loss of all or part of the principal invested.

This document does not constitute and shall not be construed as a prospectus, advertisement, public offering or placement of, nor a recommendation to buy, sell, hold or solicit, any investment, security, other financial instrument or other product or service. It is not intended to be a final representation of the terms and conditions of any investment, security, other financial instrument or other product or service. This document is for general information only and is not intended as investment advice or any other specific recommendation as to any particular course of action or inaction. The information in this document does not take into account the specific investment objectives, financial situation or particular needs of the recipient. You should seek your own professional advice suitable to your particular circumstances prior to making any investment or if you are in doubt as to the information in this document.

Although information in this document has been obtained from sources believed to be reliable, no member of the EFG group represents or warrants its accuracy, and such information may be incomplete or condensed. Any opinions in this document are subject to change without notice. This document may contain personal opinions which do not necessarily reflect the position of any member of the EFG group. To the fullest extent permissible by law, no member of the EFG group shall be responsible for the consequences of any errors or omissions herein, or reliance upon any opinion or statement contained herein, and each member of the EFG group expressly disclaims any liability, including (without limitation) liability for incidental or consequential damages, arising from the same or resulting from any action or inaction on the part of the recipient in reliance on this document.

The availability of this document in any jurisdiction or country may be contrary to local law or regulation and persons who come into possession of this document should inform themselves of and observe any restrictions. This document may not be reproduced, disclosed or distributed (in whole or in part) to any other person without prior written permission from an authorised member of the EFG group.

This document has been produced by EFG Asset Management (UK) Limited for use by the EFG group and the worldwide subsidiaries and affiliates within the EFG group. EFG Asset Management (UK) Limited is authorised and regulated by the UK Financial Conduct Authority, registered no. 7389746. Registered address: EFG Asset Management (UK) Limited, Park House, 116 Park Street, London W1K 6AP, United Kingdom, telephone +44 (0)20 7491 9111.